After building up forces on the Ukrainian border…

Russia announced that they are withdrawing 10,000 troops from the border, signaling a de-escalation.

Crisis averted…

But you have to be skeptical.

This Russia-Ukraine thing has been a hot geopolitical issue forever.

Russia wouldn’t just randomly withdraw unless something else was at play.

Well, I think I found the answer. From Reuters:

The geopolitical games being played here are all about the energy market. And in Europe, it’s getting ugly.

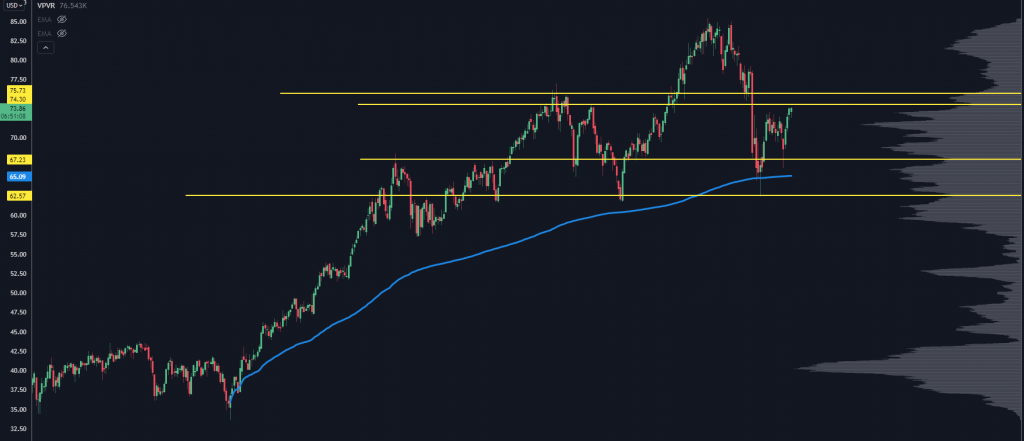

Here’s a chart of UK natural gas futures:

This tells us that Britons are paying 500% more for natural gas vs. the same time last year.

Meanwhile, some European energy providers are going bankrupt due to surging gas prices. For instance, yet another small Dutch energy provider just went under last week.

If you’re paying attention, you can see how this doesn’t lead anywhere good.

Of course, we don’t just rely on headlines for trade ideas.

You’ll get run over trying to do that. You’ll potentially fall victim to emotions and guesswork.

Instead, we use our Trading Roadmap to help tell us how the big players are positioning themselves among these events.

Here’s a look at Crude Oil futures:

After a nasty selloff at the end of November, Crude held the swing AVWAP from last November’s lows. This also lines up with a key low volume node (LVN) and price support.

A few weeks later, Crude tested an internal LVN and was bid up aggressively. These responsive buyers show us there’s still plenty of demand.

Now, we’re coming into a significant level. It’s price resistance, an LVN, and a key volume shelf right around $75/bbl.

There’s also a key VWAP from the most recent highs that’s falling to where the price is going.

This $75 area is crucial to watch, even if you don’t trade Crude futures.

It signals whether we will see continued institutional demand to bid up crude as they expect much higher prices in the future. If $75 holds and crude rolls over, you can make a case for a longer-term topping pattern.

But if it clears it, then you could be seeing the next extension of the Crude bull market higher.

Now, energy prices are a goldilocks indicator.

Too low, and it tells us the economy is tanking. Too high, and energy prices impact company margins and consumers’ abilities to buy things.

We have a position on an energy company primed to take advantage of these rising energy prices.

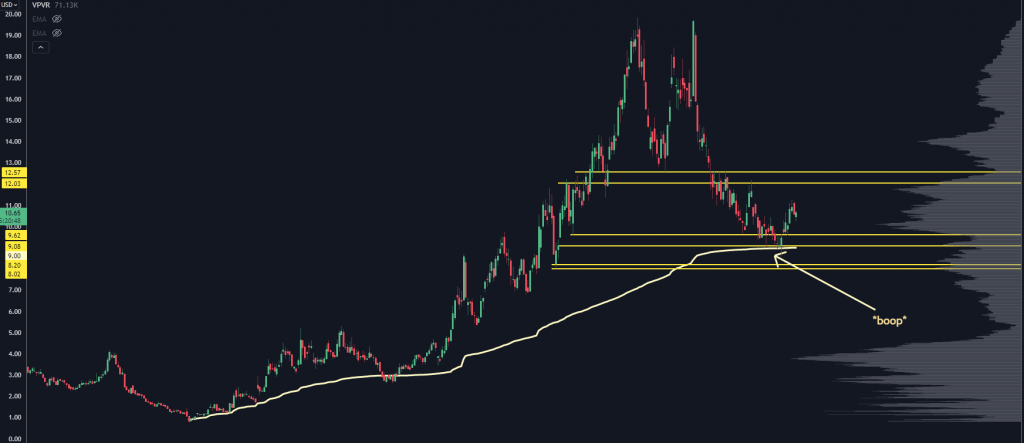

We don’t buy on the headlines. We buy based on our Roadmap, which you can see here:

Just like Crude Oil…

This name came back and tested the VWAP from last November. A retest of the recent range is a 40% potential gain, and a retest of the recent highs would be a double…

On the stock!

At the core of our ability to find these is our roadmap. If you want to learn more about it…