[vc_row][vc_column][vc_column_text]Today’s Fed meeting is shaping up to be a major market-moving event…

But we’ve been building to this point since November when Powell and co. tossed “transitory” in the trash.

Since then, the market’s been taking out any tech stocks with a high sales multiple, and we finally saw the selling bleed into large cap tech stocks this week.

All the talking heads on TV will try to keep your eyeballs glued to their analysis of “will they or won’t they?”

It’s exhausting to keep up…

And frankly, not worth your time.

Instead, focus on the markets that actually go out and price these things in.

That’s what my brand new video is all about — and I’ll use my roadmap to show you where things may go.

Once you watch that…

Click here to check out the free training I mentioned towards the end.

If you prefer reading, here’s my written analysis:

The first market you can watch is the Eurodollars futures market:

GE Stock chart

This market sets the interest rates for dollar-denominated bank accounts outside the US.

Since these are overseas accounts…

This futures market’s price movements can give you a better feel for the market’s true rate expectations vs. the Fed driving down rates by purchasing treasuries. GE is the ticker in Tradingview.

The Fed Fund Futures (ZQ in Tradingivew) is the next market to watch. This is the market that will best track market expectations for the Fed’s potential actions on interest rates.

If you look at the chart, it’s kind of hard to read. You also have to look at different futures contracts because they will price in different things.

Luckily, the CME group created a tool called “FedWatch” that shows you what the pricing is set at. You can get access to the FedWatch tool here.

Target Rate Probabilities for 26 Jan 2022 FED meeting chart

This shows us there’s a 94% chance the Fed will keep rates the same into this meeting.

This is pretty much consensus, and the Fed would cause a tantrum in the market if they threw in a surprise hike.

Because we know the hike isn’t this round…

It’s all about what they will signal over the next few months.

Will they hike?

How many times?

Now, we can also see what the market is pricing further out. Let’s go to June contracts:

Target Rate Probabilities for 15 Jan 2022 FED meeting chart

This is where it gets interesting:

We’ve got a 46% chance of 2 hikes by June…

And a 42% chance of 3 hikes!

Compare that to what we priced in a month ago:

38% chance of one hike and 40% of two hikes.

Much of the current market volatility surrounds this. The Fed has been caught on the wrong foot before — a good example being 2016’s taper tantrum:

SPY stock chart

Alright, the last market for you to watch is the 10-year Treasury market:

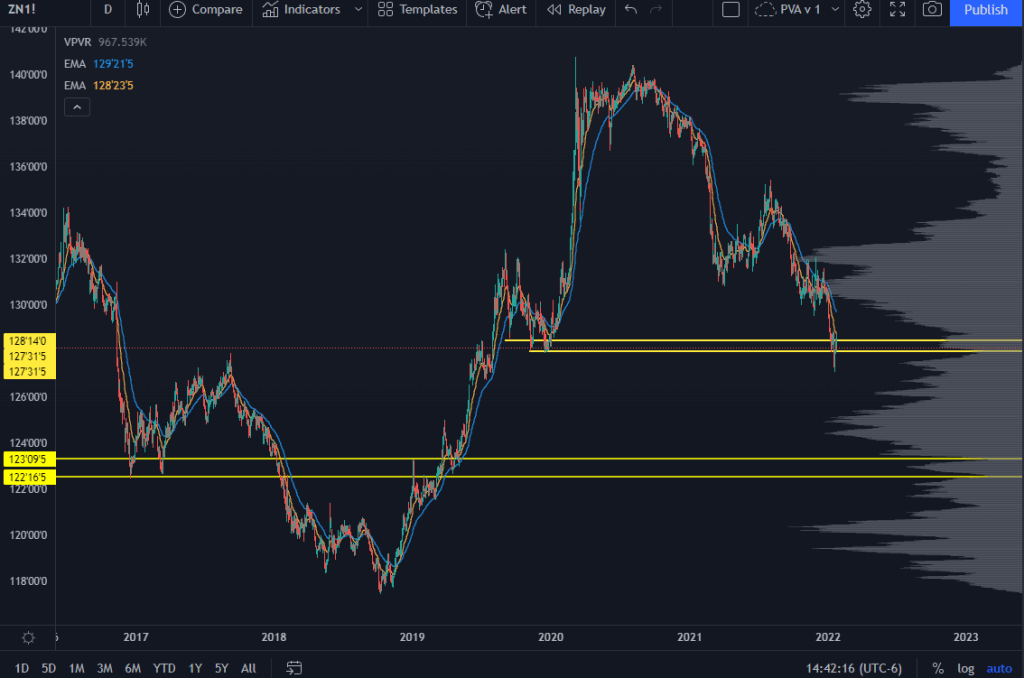

ZN stock chart

The bond market has just about normalized relative to where we started during the 2020 crash…

And it’s a key level I’m anchoring on in our Trading Roadmap.

If this level doesn’t hold, expect a move to 126 to see if we find responsive buyers into that volume shelf.

If that 126 level doesn’t hold, we’ve got a zone down in the 122’s that may provide a support level.

Now, the 10-year is a good proxy for measuring sector dynamics. Banks tend to do a little better when rates are higher because their margins improve. Their net interest income tends to increase because they often can increase lending rates more than they have to increase what they pay savers.

Meanwhile, high-growth tech fares a little worse.

What may be more important here is the magnitude of the range.

If the bond market stays quiet, along with the Fed Fund Futures market for longer durations…

That could kick off a rally in equities as we know that the bond markets had priced in any narrative shifts in the market.

Any large moves, however, will probably spill over into stocks — which is why it will be on our screens as we head into the Fed on Wednesday afternoon.

That’s all for today. Thanks for reading/watching!

If you want free training on the market roadmap I used to analyze these markets…